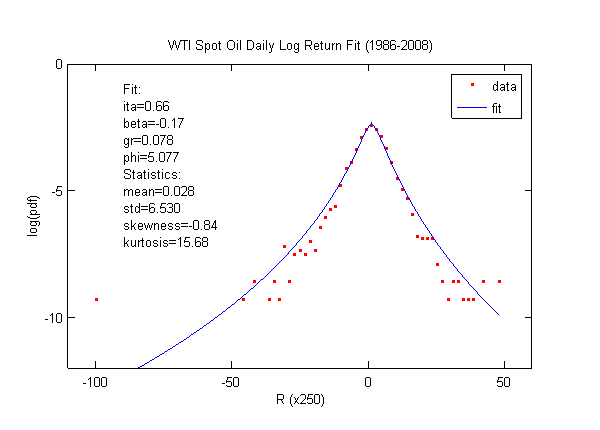

It also has negative skewness like the Dow. High volatility causes oil price to go down!

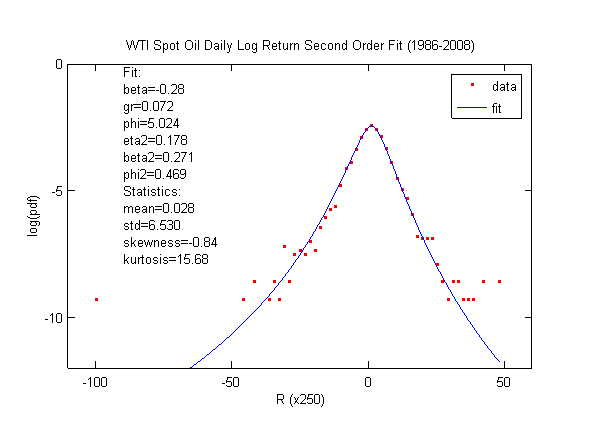

Again, the first order fit (above) over-estimates the variance and the peak probability, which are corrected in the second order fit (below). This indicates oil price has observable volatility of volatility.