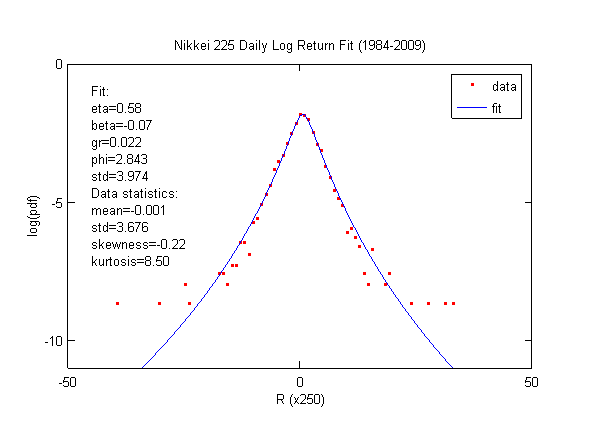

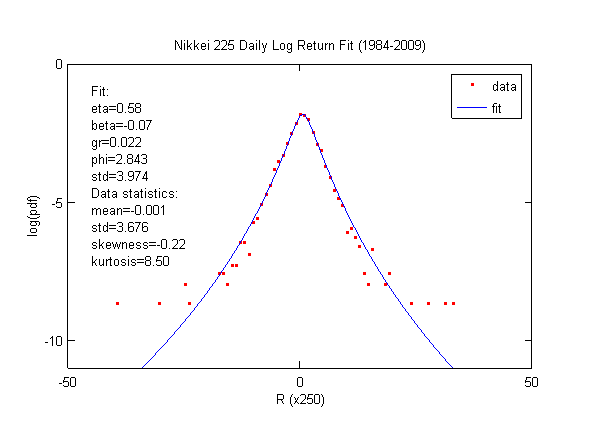

The fit exhibits similar issue as DJIA, where, in order to fit skewness and kurtosis precisely, the standard deviation is 10% larger than the actual.

It is noteworthy to point out that Nikkei 255's negative skewness is much smaller than that of the U.S. Stock Market. The readder can compare the Nikkei fit to that of Russell 2000 on this website. They have similar amount of data during the same period. The second moment and the fourth moment are very similar.

However, due to the large volatility of the late 80's and early 90's,

Nikkei's adjusted return during this period is inferior to that of Russell 2000.